🌊 The Investor’s Illusion

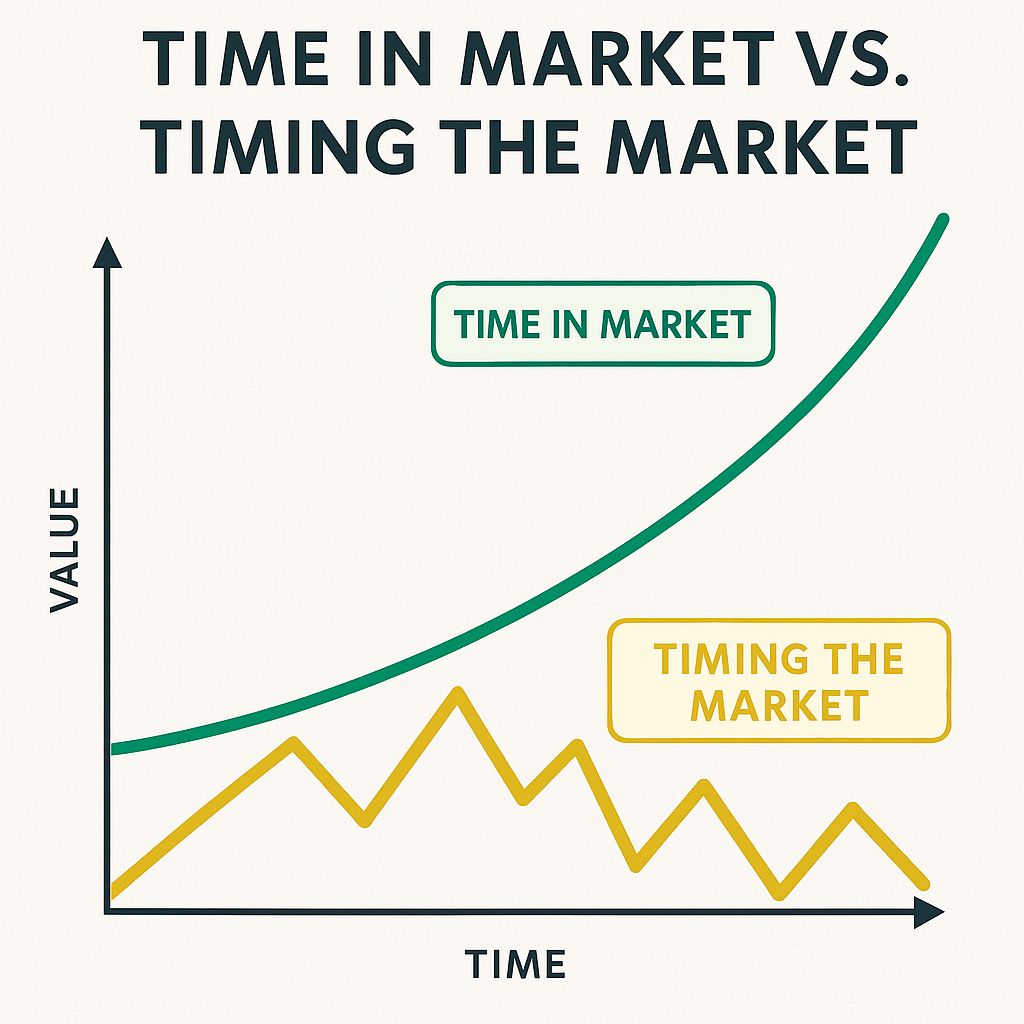

You’ve heard the cliché a thousand times: “It’s time in the market, not timing the market.”

It’s a comforting story, like telling sailors to stay at sea no matter the weather. But here’s the uncomfortable truth: timing does work… just not for 99% of investors.

The market rewards patience. But it also punishes arrogance. The myth is not that timing never works; it’s that you are probably not the one who can pull it off consistently.

⚓ Why the Debate Is Broken

Perfect timing is impossible → Even professionals miss the inflexion points.

Imperfect timing is dangerous → Most investors buy high, sell low.

Consistent patience beats occasional brilliance → Compounding needs time, not heroics.

But ignoring timing completely is also foolish → Valuations, cycles, and risk matter.

🧭 The Ark Framework: Timing vs Time

Here’s how to reframe the myth into a practical strategy:

1. Time Is the Core

Automate contributions.

Stay invested through storms.

Compounding only works if you’re present.

2. Timing Is the Edge

Instead of guessing tops and bottoms, use risk management signals:

Allocation shifts when valuations are extreme.

Hedge with gold or cash when markets overheat.

Think of it as adjusting your sails, not abandoning ship.

3. System > Prediction

Build a system that blends both:

Always invested (time) + Occasional tilts (timing).

Example: 80% core ETFs (time), 20% tactical plays (timing).

💰 Wealth Management Lens

Wealth management isn’t about being a fortune teller — it’s about being a steward.

Your Growth Bucket stays invested (time).

Your Security Bucket lets you hedge (timing).

Your Income Bucket smooths volatility.

Your Legacy Bucket compounds quietly in the background.

👉 The myth dissolves once you realise: it’s not time vs timing, it’s time + disciplined risk signals.

✍️ Quick Exercise

Write down your current portfolio split (e.g., 70% stocks, 20% bonds, 10% cash).

Ask: Is my “time” bucket big enough? Is my “timing” hedge intentional or random?

Adjust one position to reflect a conscious balance.

📊 Ark Deep Dive: Missing the Best Days

JP Morgan found that missing just the 10 best market days in 20 years cuts returns in half. The problem? The best days often cluster right after the worst days.

👉 Which means if you panic and sell during crashes, you miss the rebound.

💡 Contrarian Take

👉 “Timing works. But only if you admit you’re not the one to do it.”

❓ Q&A: Time vs Timing

Q: Isn’t timing the market always bad advice?

A: No — but it’s almost always bad advice for individuals. Institutions use timing (valuations, cycles, hedges) with discipline. For most retail investors, “stay invested” is safer than guessing.

Q: Should I never sell then?

A: Not true. You should rebalance, trim when valuations are extreme, and reallocate buckets. That’s timing as risk management, not gambling.

Q: What if I just wait for crashes to buy?

A: Many tried. Most failed. Crashes are rare and unpredictable. By waiting for the “perfect moment,” you miss years of compounding.

Q: So how do I blend both?

A: Keep 70–80% in a long-term compounding bucket. Use the rest for hedges, tilts, or tactical plays. Time + timing.

🚀 Take Action Today

Commit to always keeping your core invested.

Use risk signals (valuations, volatility) for minor tilts — not total exits.

Build your buckets: Growth (time) + Security (timing).

👉 Want to see how I balance both in practice? Copy my portfolio on eToro and follow my strategy in real time.

🔮 Next Week on The Wealth’s Ark

“What I Look for Before Copying Anyone on eToro”

A practical checklist to avoid chasing the wrong captain.

✅ Free Resource for This Issue

Compound Growth Timeline Calculator (Excel) — See how your wealth grows with time in the market vs. different timing scenarios.